Policybazaar, an insurance marketplace, has reported significant growth in FY24, showcasing a remarkable 34% increase in revenue. The company’s Profit After Tax (PAT) has seen a substantial improvement, shifting from a loss of ₹488 crore to a profit of ₹64 crore, marking a turnaround of ₹552 crore.

In Q4 FY24, the company witnessed a 47% year-on-year growth in online insurance new premium, primarily driven by the health and life insurance, which saw an increase of 53%.

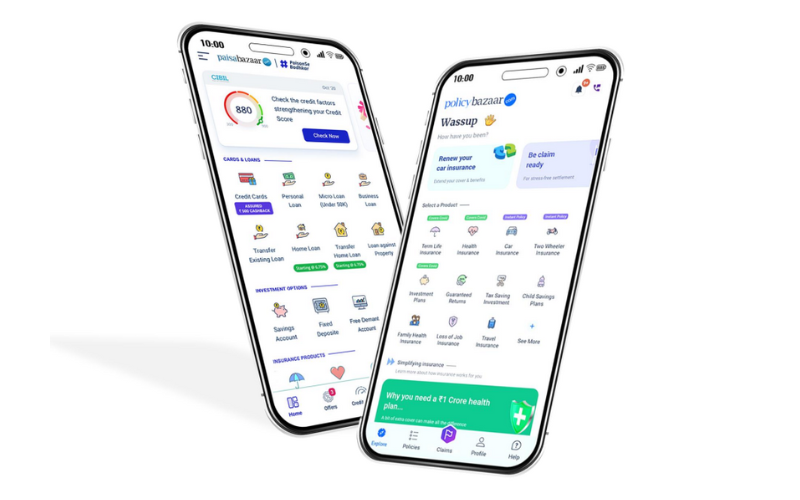

Policybazaar expressed satisfaction with their total insurance premium for the quarter, amounting to ₹5,127 crore, with an ARR of ₹20,000 crore, predominantly driven by the growth in health and life insurance segments. The company’s core online marketplaces, Policybazaar and Paisabazaar, witnessed a 39% revenue growth, reaching ₹2,375 crore, along with an improved Adjusted EBITDA of ₹324 crore for FY24.

Key highlights of Policybazaar’s FY24 performance:

- Insurance Premium reached an Annual Recurring Revenue (ARR) of ₹20,000 crore.

- Credit Disbursal ARR stood at ₹14,000 crore, with 6 lakh credit cards issued.

- New Core Online Insurance Premium surged by 47% in Q4 FY24.

- Operating Revenue reached ₹2,375 crore, marking a 39% increase.

- Contribution Margin improved to 45%, despite significant growth in new health insurance premiums.

- Adjusted EBITDA soared to ₹324 crore from ₹107 crore, with a margin increase from 6% to 14%.

- Operating Revenue surged to ₹3,438 crore, showing a 34% increase. While the adjusted EBITDA Margin improved from -5% to 4%.

- Cash position strengthened by ₹259 crore to reach ₹5,263 crore.

The company highlighted the growth in renewal/trail revenue, improvement in customer onboarding and claims support services, and the moderation in credit business growth, which remained EBITDA positive.