In a significant achievement aligning with market predictions, PB Fintech, the online insurance aggregator and parent company of Policybazaar, has achieved profitability for the first time in the December quarter.

The company posted a noteworthy profit after tax (PAT) of Rs 37 crore during Q3, an improvement of Rs 125 crore YoY, fueled by robust growth in insurance premiums, improved renewals with higher margins, and enhanced contributing margins. This marks a remarkable turnaround from the Rs 87 crore loss reported in Q3 of FY23.

Reflecting its financial strength, PB Fintech reported a substantial 43 percent YoY growth in consolidated revenue, reaching Rs 871 crore for the December quarter, compared to Rs 610 crore in the same quarter the previous fiscal year.

The company’s adjusted EBITDA margin stood at 4 percent during the quarter, a significant improvement from the negative 5 percent recorded in the third quarter of the preceding financial year. Additionally, the contribution margin climbed to 30 percent for the quarter, up from 26 percent in the corresponding quarter of the previous financial year.

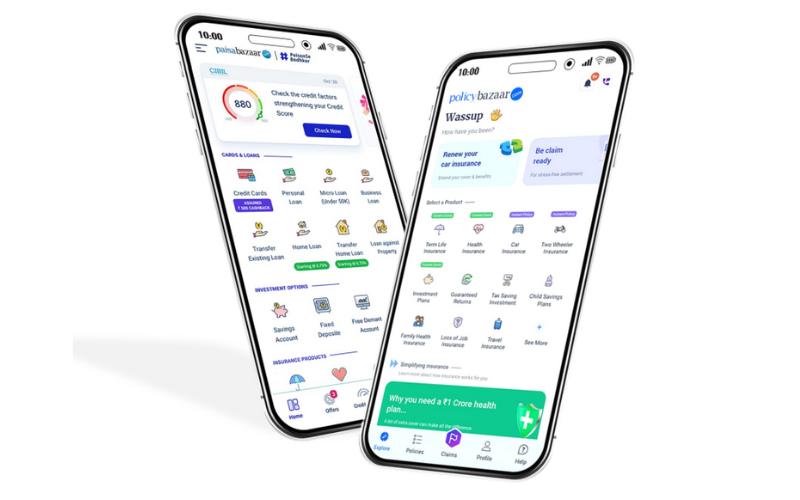

However, in the credit business under Paisabazaar, PB Fintech witnessed slower growth in the second half of the year due to a cautious approach adopted by lending partners post-regulatory measures and statements. Despite reporting Rs 16,000 crore in annualized credit disbursement during the first quarter, this figure has been recalibrated to approximately Rs 14,000 crore.