PB Fintech, the parent company of Policybazaar and Paisabazaar, reported a robust financial performance for FY25, with profit after tax (PAT) surging 448% year-on-year to ₹353 crore and revenue increasing by 45% to ₹4,977 crore. The strong results were driven by consistent growth in the company’s core insurance business, especially in health and life insurance, as well as operational efficiency across new initiatives.

For the March quarter (Q4 FY25), PB Fintech posted a 38% year-on-year rise in consolidated revenue to ₹1,508 crore. Profit after tax (PAT) for the quarter stood at ₹171 crore, up 184% compared to the same period last year. The company’s adjusted EBITDA more than doubled to ₹149 crore in Q4, reflecting continued margin improvements.

The total insurance premium sourced during FY25 reached ₹23,486 crore, registering a 48% growth from the previous year. New health and life insurance premiums alone grew by 48%, underlining the increasing demand for protection products. The company’s renewal revenue grew 42% year-on-year to an annualized run rate of ₹817 crore, a key indicator of long-term profitability.

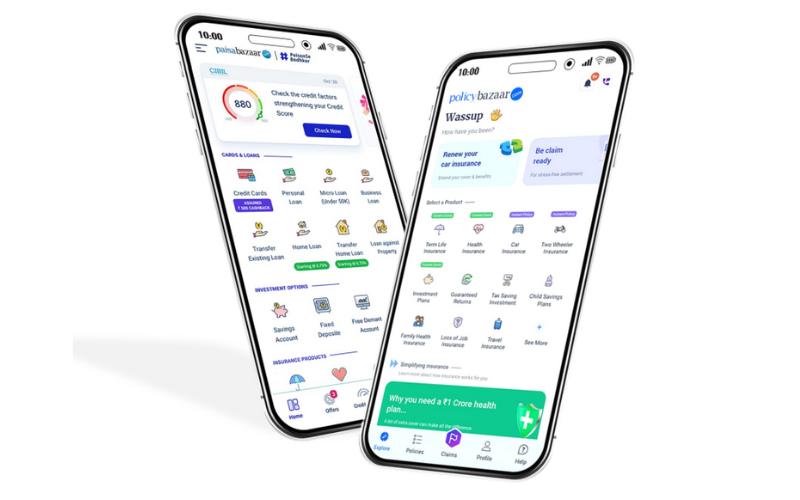

On the credit side, Paisabazaar disbursed loans worth ₹20,465 crore in FY25, a 38% jump year-on-year. The credit business contributed ₹500 crore in revenue, while trail revenues—recurring earnings from previous disbursals—now form over 16% of PB Fintech’s overall revenues.

PB Fintech’s new initiatives, including its agent platform PB Partners and international business in the UAE, also showed strong momentum. Revenue from new initiatives grew 79% year-on-year to ₹1,904 crore in FY25, while adjusted EBITDA losses narrowed to ₹168 crore, reflecting improved operational efficiency.

The company’s performance since its IPO in November 2021 reflects consistent growth. Revenue has grown at a CAGR of 52% from ₹1,425 crore in FY22 to ₹4,977 crore in FY25, while PAT margin improved from -58% to +7% in FY25 at ₹353 over the same period. The company also reported a closing cash balance of ₹5,406 crore.