In the race to modernize India’s economic landscape, the nation has witnessed a rapid surge in digital transactions. As cash transactions wane, the rise of online business transactions has become the new norm. Yet, during the early phase of this transformation, a noticeable gap existed: while fintech solutions targeted consumers, merchants were often left in the lurch, hesitant to join the online payment revolution.

Enter Paytm, the front-runner in India’s digital payment sector, filling this void.

Paytm: Bridging the Online Payment Gap for Merchants

Paytm, recognized for its trailblazing solutions, has cultivated a balanced ecosystem, assisting merchants in their shift towards digital payments. Boasting a collaboration with almost 4 crore merchants, Paytm’s innovative devices and payment strategies have dramatically influenced businesses nationwide.

Their 92 lakh device deployments further underscore their dominance in the offline payment realm, solidifying their position as the leader in peer-to-merchant transactions.

Here’s a deeper look into five offerings that underscore Paytm’s monumental role in shaping India’s online merchant landscape:

1. The QR Code Wave: In 2015, Paytm introduced India to a game-changing method of digital payment – the QR code. This seemingly simple yet transformative solution enabled merchants of all sizes to facilitate instant transactions.

The ubiquitous presence of Paytm’s blue and white QR code at various establishments across the nation attests to its sweeping success and its pivotal role in spearheading the country’s move towards a digital economy.

2. Soundbox: The Digital Cash Register: Another feather in Paytm’s cap is the Soundbox, a device designed to instantly notify merchants of successful transactions via sound alerts.

Tailored for India’s diverse linguistic landscape, the Soundbox supports languages, from Hindi to Odia, ensuring inclusivity. Its ability to integrate with multiple payment methods, including the Paytm Wallet, UPI apps, debit card and credit card, has made it an indispensable tool for small to medium-sized businesses across the nation.

3. Empowering Growth with Merchant Loans: Moving beyond payment solutions, Paytm, in collaboration with renowned financial institutions, extends credit facilities to its vast network of merchants.

This initiative serves as a boon for businesses, granting them timely access to working capital and thereby fueling their growth. The burgeoning number of businesses availing these loans through Paytm attests to the program’s success and impact.

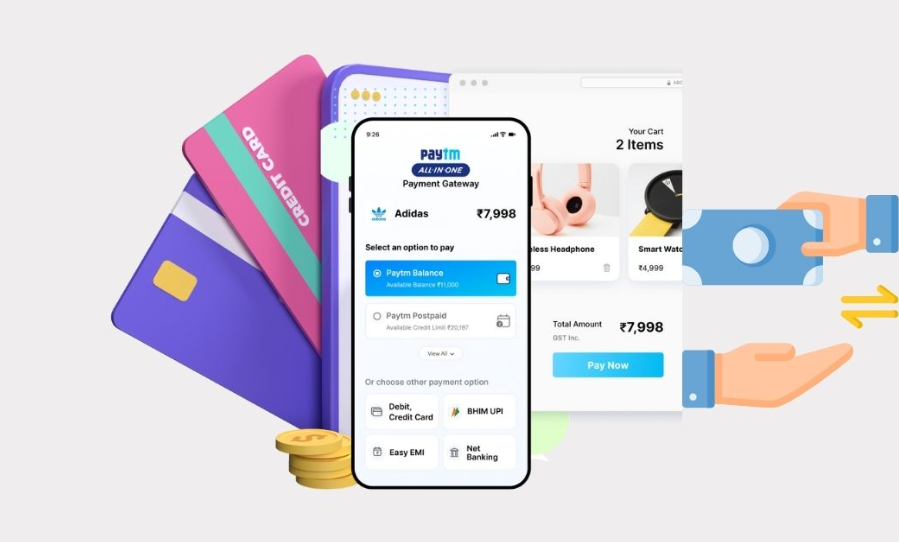

4. Unifying Payments with the Paytm Gateway: Paytm’s Payment Gateway stands tall as one of India’s premier payment aggregators, supporting numerous top-tier brands. Its comprehensive platform offers an array of payment solutions, simplifying transactions for online merchants.

Key features such as instant activation for new vendors, access to all major payment instruments, next-day settlements, and secure card tokenization, set it apart.

5. Facilitating Commerce Expansion: Beyond its core payment functionalities, Paytm offers merchants a platform to amplify their reach. From ticket sales to deal promotions, businesses can tap into Paytm’s expansive user base.

The increasing demand for Paytm’s commerce and cloud services suggests its burgeoning appeal amongst merchants eager to extend their market footprint.

By identifying and addressing the gaps in the merchant-consumer dynamic, Paytm has not only propelled India’s move towards a cashless economy but also ushered in a new era of digital entrepreneurship. As the nation continues its digital journey, the contributions of pioneers like Paytm remain etched in its economic blueprint.