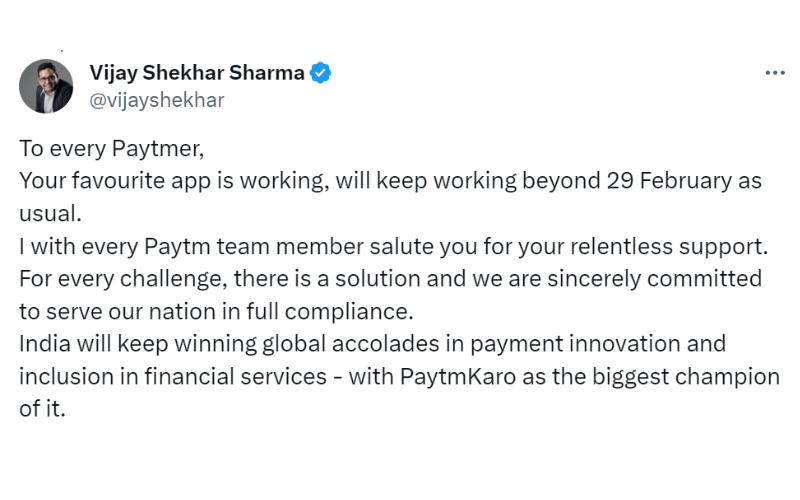

Paytm’s founder and CEO, Vijay Shekhar Sharma, on Friday said that the app is working and will keep working beyond February 29 as usual. “To every Paytmer, Your favourite app is working, will keep working beyond 29 February as usual,” he tweeted.

He further saluted the support the company and its members are receiving by saying, “I with every Paytm team member salute you for your relentless support. For every challenge, there is a solution and we are sincerely committed to serve our nation in full compliance. India will keep winning global accolades in payment innovation and inclusion in financial services – with PaytmKaro as the biggest champion of it.”

The tweet by the CEO, has ended all the rumors saying that the Paytm App will stop working post the directives issued by the Reserve Bank of India (RBI) to Paytm’s associate bank on January 31, 2024.

The fintech company in an exchange filing informed that its associate bank is taking immediate steps to comply with RBI directions, including working with the regulator to address their concerns as quickly as possible. It also informed that this does not impact user deposits in their savings accounts, Wallets, FASTags, and NCMC accounts, where they can continue to use the existing balances.

Notably, Paytm works with various banks and not just with its associate on various payments products. It started to work with other banks since the last 2 years and will now accelerate the plans and completely move to other bank partners. The next phase of Paytm’s journey is to continue to expand its payments and financial services business, only in partnerships with other banks.