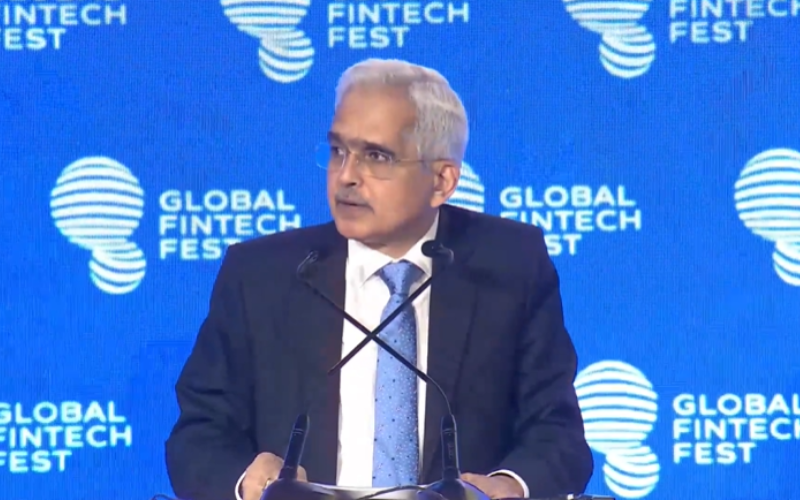

The Reserve Bank of India (RBI) Governor, Shaktikanta Das, has announced the launch of two new product offerings by the National Payments Corporation of India (NPCI) at the Global Fintech Festival (GFF) 2024. These offerings, Bharat BillPay for Business and UPI Circle, are set to revolutionize India’s digital payment ecosystem by enhancing the inclusivity, security, and efficiency of transactions.

“These new offerings include Bharat BillPay (BBPS) for Business, designed to streamline business-to-business (B2B) transactions across different ERPs and accounting platforms, and UPI Circle, which enables delegate payments to users,” NPCI said in a release.

Bharat BillPay for Business

Bharat BillPay (BBPS) for Business is an expansion of the BBPS services, specifically designed to cater to business-to-business (B2B) transactions. This platform aims to streamline and standardize invoice payments across different Enterprise Resource Planning (ERP) systems and accounting platforms.

By offering features like business onboarding, search and add business, purchase order (PO) creation, invoice management, automated reminders, guaranteed settlement, financing, AR (Accounts Receivable) and AP (Accounts Payable) dashboard, and online dispute resolution, BBPS for Business provides a comprehensive solution for businesses of all sizes. Also, these offerings are inbuilt in this platform.

This centralized, interoperable platform simplifies the complex processes of business payments and collections, enabling businesses to transition from manual operations to a fully digital ecosystem. Banks, ERPs, and fintech companies can now connect with BBPS for Business to offer their clients a seamless digital payment experience, thereby enhancing operational efficiency and reducing the risks associated with manual payment processes.

UPI Circle

The RBI Governor also unveiled UPI Circle, a feature that allows UPI users to delegate payments to trusted secondary users. UPI Circle offers two modes of delegation: full and partial. In full delegation, the primary user authorizes a secondary user to initiate and complete UPI transactions within a specified limit, while in partial delegation, the primary user then completes the UPI transaction with UPI Pin.

UPI Circle is designed to enhance the flexibility and convenience of digital payments, allowing up to five secondary users per primary account. Full delegation allows a maximum monthly limit of Rs. 15,000 per delegation and a maximum per transaction limit of Rs. 5000. Existing UPI limits will be applicable in case of partial delegation.