PB Fintech, the parent company of PolicyBazaar, Paisabazaar, and PB Partners, announced its third consecutive profitable quarter in Q1 of FY25. The company achieved a net profit of ₹60 crore, a significant turnaround from a ₹12 crore loss in the same period last year. The company had reported net profits of ₹38 crore and ₹60 crore in Q3 and Q4 of FY24, respectively.

The company’s revenue saw a substantial increase, rising to ₹1,010 crore, up 52% from ₹666 crore in the same quarter of the previous year. This growth was driven by a 62% year-on-year increase in premiums from the online business, particularly a 78% spike in the health and life insurance segment.

““Har Family Hogi Insured!” We aim to protect every family in India against the financial impact of Death, disease & disability by having Health and Life insurance. We continue expanding our regional reach using TV campaigns in regional languages like Tamil, Telugu and Marathi and offering sales support in 230+ cities in 18 languages,” PB Fintech stated in the earnings call.

The total insurance premium for the quarter was ₹4,871 crore, with renewals and trial Annual Recurring Revenue (ARR) reaching ₹559 crore, up from ₹418 crore in the same quarter last year. The company highlighted that this segment typically operates at over 85% margins, contributing significantly to profit growth.

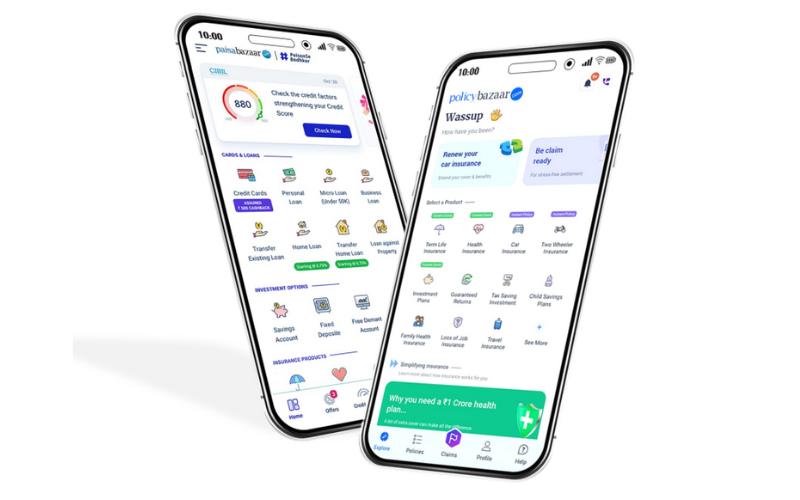

However, PB Fintech’s credit business, Paisabazaar, experienced a slowdown. Loan disbursals decreased by 11% quarter-on-quarter to ₹3,140 crore in Q1, down from ₹3,542 crore in the previous quarter. Additionally, the firm sold 1.34 lakh credit cards, compared to 1.4 lakh in the previous quarter. Despite this, the company has remained adjusted EBITDA positive since December 2022.

Founded by Yashish Dahiya in 2008, PB Fintech operates insurance and credit marketplaces PolicyBazaar and PaisaBazaar, offering comprehensive insurance and credit solutions to consumers.