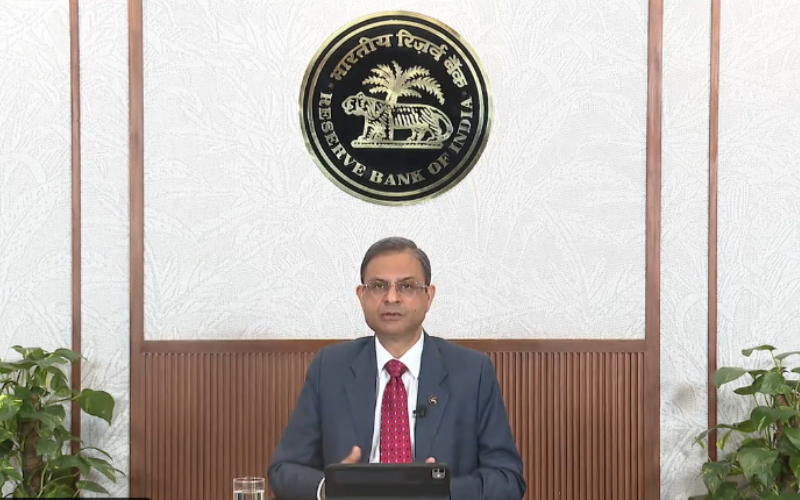

In a significant move to support innovation and flexibility in India’s fast-evolving digital payments landscape, the Reserve Bank of India (RBI) has proposed a new framework that allows the National Payments Corporation of India (NPCI) to determine and revise UPI transaction limits in consultation with ecosystem stakeholders. The announcement was made during the 54th meeting of the Monetary Policy Committee (MPC) held from April 7 to 9, 2025.

Currently, Unified Payments Interface (UPI) transactions — both Person-to-Person (P2P) and Person-to-Merchant (P2M) — are capped at ₹1 lakh, with specific exceptions for certain high-value merchant payments. Under the new policy, NPCI will have the authority to revisit and adjust these limits based on emerging user needs and use cases. However, P2P transactions will continue to be limited to ₹1 lakh.

“At present, the transaction amount for UPI, covering both Person to Person (P2P) and Person to Merchant payments (P2M), is capped at ₹1 lakh except for specific use cases of P2M payments which have higher limits, some at ₹2 lakh and others at ₹5 lakh. To enable the ecosystem to respond efficiently to new use cases, it is proposed that NPCI, in consultation with banks and other stakeholders of the UPI ecosystem, may announce and revise such limits based on evolving user needs. Appropriate safeguards will be put in place to mitigate risks associated with higher limits. Banks shall continue to have the discretion to decide their own internal limits within the limits announced by NPCI. P2P transactions on UPI shall continue to be capped at ₹1 lakh, as hitherto. NPCI will be advised accordingly,” RBI said in a release.

This flexible approach is expected to unlock new possibilities for high-value use cases in sectors such as healthcare, education, and retail, while also encouraging wider adoption of digital payments across India. Banks will retain the discretion to set their own internal caps within the overall limits defined by NPCI. This measure is part of a broader suite of developmental and regulatory policies aimed at modernizing India’s financial infrastructure.

The RBI also announced a 25 basis point reduction in the policy repo rate to 6.00%, alongside proposals to update frameworks related to securitisation of stressed assets, co-lending arrangements, and lending against gold jewellery.